reit dividend tax canada

BMO Equal Weight REITs Index ETF ZRE ZRE is one of the best REIT ETFs in Canada. It is managed by the Bank of Montreals Global Asset Management division was.

REITs typically pay quarterly dividends most Canadian REITs pay monthly.

. Governments provide tax breaks to REITs when they distribute most of their earnings to shareholders so they tend to have high dividend yields. Consider this example. The average yield for REIT Residential is 271 and contains some of the Canadian Dividend Aristocrats from the REIT industry.

The ROC will reduce the. Investor owns 5 or less of a. The income they generate is then paid out to its shareholders in the form of dividends.

This index tracks 19 Canadian REITs that pay dividends and rebalances twice a year in January and July. 28 rows While US. With excellent overall features VRE is a great REIT ETF on the Canadian ETF shelf.

5 Year Dividend Growth Rate. REITs are required to pay out at least 90 of their taxable income to shareholders and most can even. Taking into account the 20 deduction the highest effective tax rate on Qualified REIT Dividends is typically 296.

The indexs holdings are based on the REITs risk-adjusted dividend. When the individual taxpayer is subject to a lower scheduled income tax rate. 30 tax rate if shareholder owns 25 or more of the REITs stock.

If you love steady performance and a. The next step is to actually choose one. Your ACB is 200 and the REIT pays a distribution of 800 consisting of 100 other income 400 capital gain and 300 ROC.

With a market cap of. Jamaica and no more than 25 of the REITs income consists of dividends and interest. REITs voting stock and in the case of REIT dividends paid to a c orp or.

The ETF is labeled as being medium risk by Vanguard which is standard for most REIT ETFs. 5 tax rate if the corporate shareholder. The tax rates in the chart apply to REIT capital gain distributions so long as the non-US.

The REIT or Real Estate Investment Trust is a commonly overlooked investment asset that can be utilized to gain exposure to real estate. Ad Whether New to ETFs or a Seasoned Investor We Offer the Complete ETF Investing Experience. 15 tax rate if shareholder.

Finding The Reit Income Opportunity In 2020 Horizons Etfs

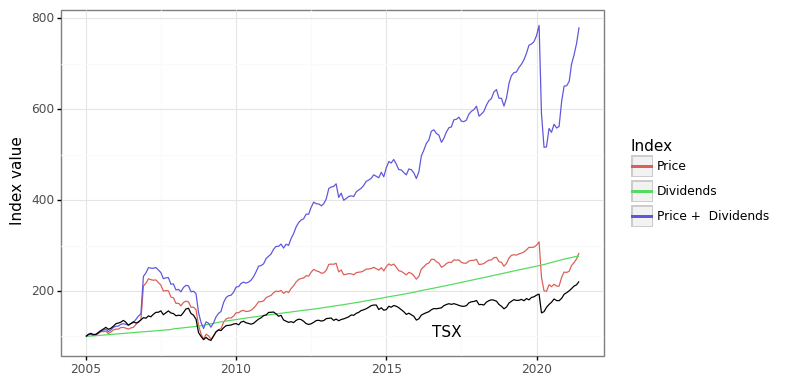

Canadian Real Estate Investment Trusts Reits

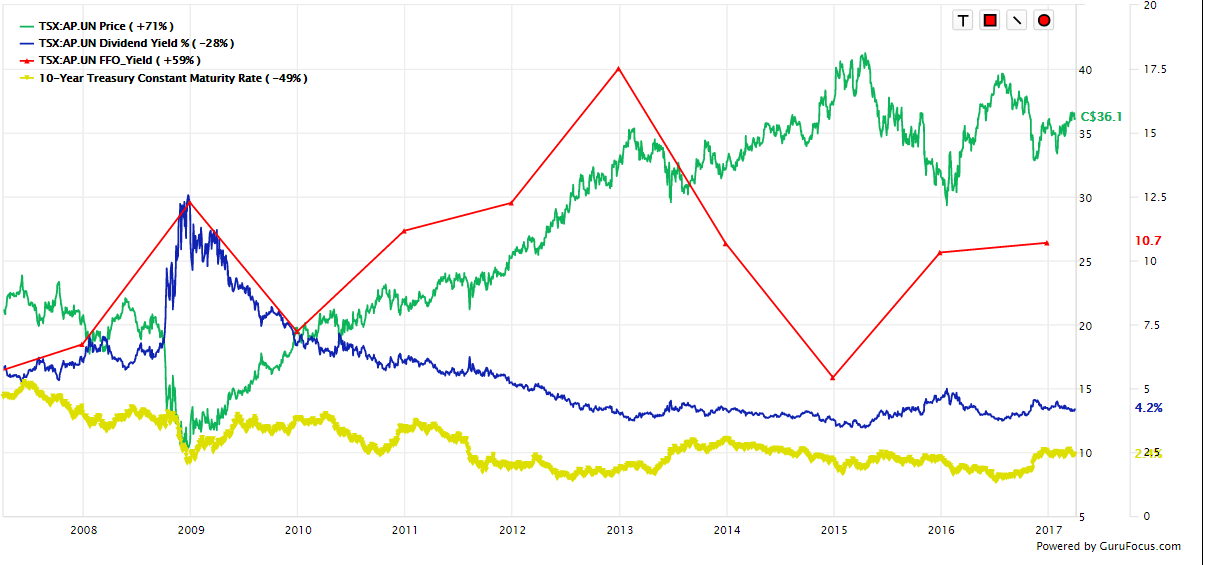

Introduction To Canadian Reits Seeking Alpha

Tax Implications For U S Investors Owning Canadian Stocks

A Short Lesson On Reit Taxation

Can Reits Replace Investment Properties Financially Yours

Introduction To Canadian Reits Seeking Alpha

Reit Taxation A Canadian Guide

Best Canadian Reit Etfs Real Estate Etfs For Dividends Passive Income Investing Tfsa Rrsp Youtube

Cracks In Consumer Global Inflation Reit Dividend Hike

U S And Canadian Tax Consequences Sf Tax Counsel

These Reits Pay Dividends Over 6

How Dividend Reinvestments Are Taxed

Finding The Reit Income Opportunity In 2020 Horizons Etfs

Best Monthly Dividend Stocks In Canada For 2022

12 Reits Flaunting Fast Growing Dividends Kiplinger

Shorting The Canadian Housing Market With Reits Erik Drysdale Bioeconometrician